This month, the AICPA has released an additional 140 free CPA Exam questions to all candidates. THIS NEVER HAPPENS! These questions are recently used questions on actual past CPA exam tests. These questions could be very helpful for understanding what types of questions have been tested to candidates in the very recent past.

- Sample Cpa Exam Questions And Answers

- Sample Cpa Exam Questions Pdf

- Sample Cpa Exam Questions And Answers Pdf

- Audit Cpa Exam Sample Questions

Please take note that although the questions provided by the AICPA do offer the correct answer choice, they do not provide an answer explanation. To view all answer explanations, you can purchase additional CPA Exam test-bank materials, to quiz yourself on questions that have been asked on past CPA exams followed by your CPA review course providers explanation of correct (and incorrect) solution explanations. You can download your free additional AICPA questions at the AICPA website, or you could practice with them buy trying our free CPA test bank products.

Universal CPA Review also offers an additional 5,000 CPA test-bank questions and over 200 never before seen task-based simulations. There is an enormous amount of information that needs to be absorbed in order to pass the CPA exam, so sometimes the best approach for studying just requires more repetition.

Our free CPA practice exams and study resources will help you pass the challenging CPA exam. The CPA designation is one of the most prestigious certifications someone can get in the accounting industry.

CPA candidates can expect to put in some long hours while preparing to take the CPA exam. There are numerous requirements that must be met before candidates can sit for the exam.

CPA Exam Questions. Free cpa practice questions and answers to pass free cpa exam questions. For cpa certification practice questions free you must go through real exam. For that we provide Free cpa Practice Exam 2021 real test. We discuss in these Free Examination for Certified Public Accountant (CPA) Test Questions from different topics like. Sample CPA Exam Questions. Prepare for the CPA exam with these quick quizzes and get immediate results. Auditing & Attestation / AUD / Start Quiz.

Those who hold a CPA designation will be distinguished from their colleagues who only hold an accounting degree. CPA candidates should expect a pay bump and an increase in responsibilities after earning their CPA designation.

For more information on how to advance your career in accounting, check out our study resources provided below.

Summary: Try a free CPA practice test below. Check out some of the other resources for more help!

Free CPA Practice Tests & Exam Questions

We have compiled a list of free CPA questions and answers. Check out these free CPA sample questions (some of which are PDF/downloadable).

| Resource | Notes | Questions | Includes Explanations? |

| Official CPA Practice Exam | Latest CPA Sample Exams from AICPA. Simulates actual test environment | 66 | No |

| AUD Practice Test | From AICPA | 10 MCQ, 6 TBS | No |

| BEC Practice Test | From AICPA | 10 MCQ, 6 TBS, 2 WCT | No |

| FAR Practice Test | From AICPA | 10 MCQ, 6 TBS | No |

| REG Practice Test | From AICPA | 10 MCQ, 6 TBS | No |

| CPA Exam Sample Questions | From NJCPA. Questions from Roger/U-world | 96 Total (24/section) all MCQ | Yes |

| CPA Review for Free | 900+ questions. Requires registration. Pushes paid product. Affiliated with Fastforward Academy | 965 MCQ | Yes |

| Gleim Free CPA Questions | Requires registration. Simulates test environment. Answers are not available until you submit testlet. Can review exam, but can only take once. | 276 MCQ, 28 TBS | Yes |

| Official CPA Exam Questions Released (PDF) | From MOCPA. AICPA released questions from previous CPA exam. | 140 MCQ | No |

| Wiley CPA Pop Quiz (PDF) | From Wiley/EfficientLearning.com | 100 MCQ | Yes |

CPA Review COUPON & DISCOUNT CODES

CPA Review Courses

If you feel you need more help than what these resources provide, please check out our review of the best CPA review courses.

| CPA Review | Universal CPA | Surgent CPA Review | Becker | Wiley CPA | Gleim | Yaeger |

| Best For | Visual Learners Saving Time | Visual Learners | Live Online Visual Learners | Live Online | Readers, Flash Cards | Readers, Flash Cards |

| Rating | ||||||

| Pricing | $1,850$1,295 Get Exclusive Discount | $2,399$1,499 Get Exclusive Discount | $2,399$1,949 View Coupons | $2,499 | $1,999 | $1,649 |

CPA Flashcards

| Resource | Notes |

| BEC Flashcards | 157 BEC flashcards (Quizlet) |

| AUD Flashcards | 78 AUD flashcards (Quizlet) |

| REG Flashcards | 260 REG flashcards (Quizlet) |

| FAR Flashcards | 207 FAR flashcards (Quizlet) |

Other Free CPA Study Resources

Check out these other CPA exam resources.

| Resource | Notes |

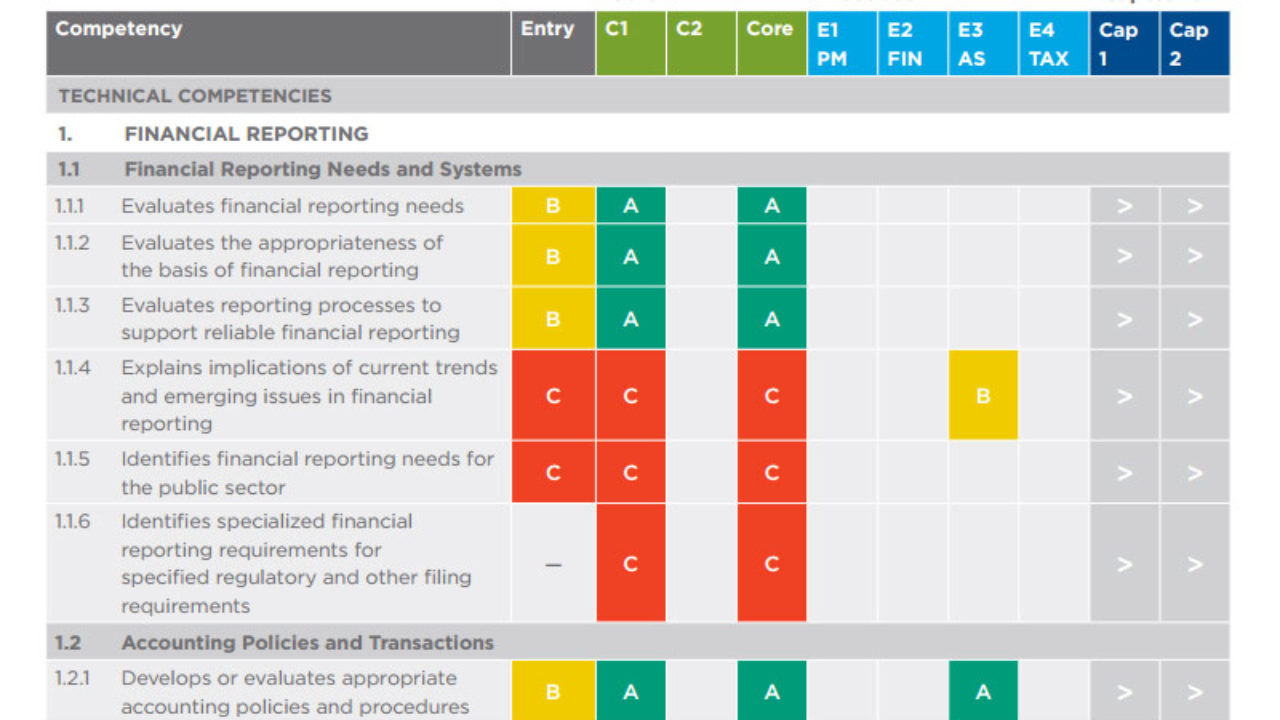

| CPA Exam Blueprints | Latest CPA exam blueprints from AICPA. |

| Latest CPA Exam Candidate Bulletin (PDF) | NASBA CPA exam information |

| CPA Subreddit (Forum) | Forum on Reddit for CPA candidates |

CPA Formulas you should know

| Name | Formula |

| Profit Margin | Net Income/Net Sales |

| Asset Turnover | Net Sales/Average Assets |

| Financial Leverage | Assets/Equity |

| Return on Assets | Net Income/Average Assets |

| Return of Equity | Net Income/Average Equity |

| Return on Sales | Net Income/Sales |

| Capital Turnover | Sales/Capital |

| Return on Investment | Income/Capital |

| Gross Margin Ratio | Gross Margin/Net Sales |

| Operating Profit Margin | Operating Profit/Net Sales |

| Ending Inventory | Beginning Inventory+Purchases-Cost of Sales |

| Retained Earnings | Beginning Retained Earnings+Net Income-Dividends |

| Contribution Margin | Sales-Variable Costs |

| Pension Formula | Contributions+Expected Rate of Return-Service Costs-Interest Costs |

| Basic EPS | Earnings Per Common Share/Weighted Average Common Stock Shares Outstanding |

| Times Interest Earned (TIE) | EBIT/Interest Payments |

| Operating Leverage | % Change EBIT / % Change Sales |

| Quick Ratio | (Current Assets-Inventory)/Current Liabilities |

| COGS | Beginning Finished Goods+Cost of Goods-Ending Finished Goods |

| Inventory Turnover | COGS/Average Inventory |

| Accounts Payable Turnover | COGS/Average Accounts Payable |

| WACC | (Cost of Equity x Weight of Equity)+ Cost of Debt x (1-Tax Rate) x Weight of Debt |

| Payback Period | Initial Investment/Yearly Cash Flows |

| Market Capitalization | Common Stock Price Per Share x Number of Common Stock Shares Outstanding |

| Dividend Payout Ratio | Dividends/Net Income or Yearly Dividends Per Share/EPS |

| P/E Ratio | Common Stock Price Per Share/EPS |

| Market to Book Ratio | Market Value/Book Value |

| Book Value Per Share | Common Stock Equity/Common Shares Outstanding |

| Breakeven | Fixed Costs/Contribution Margin |

CPA REVIEW COURSES VS DIY STUDY

With CPA exam pass rates hovering around 50%, students should utilize all possible study resources when preparing for the CPA exam. While there are plenty of free CPA study materials out there, students may be better off using those free resources as supplements to a CPA review course.

(click on image to enlarge)

CPA review courses will cover all materials that will be tested on the CPA exam. As well as covering all materials, they will also be continuously updated to reflect the most current information. Think of a CPA review course as an investment – those who earn their CPA designation should expect a pay bump. Some companies may even pay for some of the costs associated with CPA review courses.

Benefits of CPA Review Courses

- Study Schedules – Most CPA review courses will offer personalized study schedules for students. These schedules will help keep students on track and meet their study goals.

- Updated Information – CPA review courses will be continuously updated and provide the most current information students should know before heading into their CPA exams.

- Comparable to Actual Test – Top CPA review courses will offer practice exams that simulate the actual CPA exam (both in content and user interface). This is a great way to prepare for the CPA exam.

- Diagnostics – CPA review courses are starting to use advanced analytics and diagnostics to help students identify which areas they need to study and review the most. These advanced features will save students tons of time by studying more efficiently.

Bottom Line - If your career is riding on your success on the CPA exam and you have the budget, a top CPA review course is a great option.

CPA Exam Outline

The CPA exam is made up of 4 different sections. Each section takes 4 hours to complete and a total of 16 hours to complete the CPA exam. The four sections on the CPA exam include Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG), and Business Environment and Concepts (BEC).

Does Studying For The CPA Make You Want to B-A-R-F?

The CPA exam uses three different questions types – multiple choice (MCQ), task-based simulations (TBS), and written communication tasks (WCT). Read below for more information on specific questions and how each section is weighted.

- Multiple Choice – The CPA exam uses standard formatting for their multiple-choice questions. The questions will vary in length (a couple sentences) and will have 4 answer choices.

- Task-Based Simulations – These types of questions will be based on “real-world” problems. Candidates will have to type in their answers. Some problems may be based around journal entries, audit, and analyzing reports.

- Written Communication Tasks – These types of questions will challenge candidates and their ability to communicate effectively. Candidates will be required to submit a written response to various questions.

CPA Exam by Section

| Section | Time | Multiple Choice Questions | Task-Based Simulations | Written Communication |

| Auditing and Attestation (AUD) | 4 Hours | 72 | 8 | |

| Financial Accounting and Reporting (FAR) | 4 Hours | 62 | 4 | 3 |

| Regulation (REG) | 4 Hours | 66 | 8 | |

| Business Environment and Concepts (BEC) | 4 Hours | 76 | 8 |

CPA Concepts and Weights by Section

Auditing and Attestation

- Ethics, Professional Responsibilities, and General Principals: 15-25%

- Assessing Risk and Developing a Planned Response: 20-30%

- Performing Further Procedures and Obtaining Evidence: 30-40%

- Forming Conclusions and Reporting: 15-25%

Financial Accounting and Reporting

- Conceptual Framework, Standard-Setting, and Financial Reporting: 15-25%

- Select Financial Statement Accounts: 30-40%

- Select Transactions 20-30%

- State and Local Governments: 5-15%

Regulation

- Ethics and Professional Responsibilities: 10-20%

- Business Law: 10-20%

- Federal Taxation of Property Transactions: 12-22%

- Federal Taxation of Individuals: 15-25%

- Federal Taxation of Entities: 28-38%

Business Environment and Concepts

- Corporate Governance: 17-27%

- Economic Concepts and Analysis: 17-27%

- Financial Management: 11-21%

- Information Technology: 15-25%

- Operations Management: 15-25%

Registering for the CPA Exam

When registering for the CPA exam, candidates should plan on the process taking 1-2 months. The first thing a candidate should do is decide which state they will be practicing in. This will usually be determined by where the candidate intends to work – some states may be more appealing than others based on different requirements.

Before registering, candidates should check with their planned state of registration and make sure all requirements are met. Candidates should gather all transcripts from their undergraduate and graduate classes. Some states have pre-evaluation services that candidates can utilize. The length of time for registration varies from state to state but applicants should plan on 1-2 months.

When applicants register, they can decide whether they want to sit for part of the CPA exam or the whole exam. Candidates will be sent a Notice to Schedule once they are registered. A NTS is an official document that allows candidates to schedule testing with Prometric – the official proctoring service for the CPA.

After receiving a Notice to Schedule, candidates can pick testing dates. Candidates can take the exam sections in any order they choose. A general rule of thumb says that candidates should reserve their seats within 45 days of their test date, but they can reserve a spot up to 5 days before the exam.

Sample Cpa Exam Questions And Answers

The costs associated with the CPA exam varies from state to state. When taking the CPA exam, candidates should expect to pay an application fee and a fee for each individual section on the CPA. Generally, candidates should be prepared to pay $900-$1000 if they are taking the whole CPA exam.

Taking the CPA Exam

The CPA exam is administered during 8 months of the year. The months that the exam is not administered in are March, June, September, and December. In the other 8 months the exam is administered, testing is available to candidates 5 or 6 days per week. The company that proctors the CPA exam is Prometric.

There are a couple of rules to keep in mind when scheduling your CPA exam:

- Candidates can take one section, some sections, or all sections of the CPA exam during the same testing period

- Sections can be taken in any order

- Candidates cannot take the same section of the CPA exam during the same testing period.

Prometric has testing centers in all 50 states. In addition to having testing centers in the states, they also have testing centers in Guam, Puerto Rico, and the U.S. Virgin Islands.

CPA Requirements

CPA requirements are tricky. Each state has their own requirements for candidates who wish to sit for the CPA exam. In general, states have requirements for the following categories:

- Degree Required

- Certain Number of Credit Hours Required

- Credit Hours in Specific Courses Required

- Some States Require U.S. Citizenship

- Some States Require State Residency

- Age Requirement

- Social Security Number Requirement

- Work Experience Required

- Continued Professional Education – Once Candidates Earn Their CPA

CPA Exam FAQs

Which is the hardest of the CPA exams?

What kind of questions are on the CPA exam?

Can you self-study for the CPA?

Sample Cpa Exam Questions Pdf

CPA Scores

The four sections on the CPA exam are each graded separately. Each section is scored on a scale from 1 to 100. The minimum passing score on each section is 75. A candidate must score at least a 75 on each section of the CPA exam to receive their CPA designation. Candidates can expect to receive their scores about 2 weeks after taking their last test.

Sample Cpa Exam Questions And Answers Pdf

Good Luck with Your CPA Review!

The sample CPA practice exam questions that we have included above will help you prepare for your final test and discover ways to boost your abilities. So be sure to take our free CPA practice tests and review the areas that need some help. Good luck!

Audit Cpa Exam Sample Questions

Last Updated: 4/6/2021